Welcome to the Conference of the World Forum of Central Securities Depositories. This year the event was held online across three days between 30 May and 1 June, and below in the agenda section you will find details on further topics that were explored.

CSD engagement in Sustainable Development

Facilitating cross-border investment flows

Technology Vision for FMIs

Business optimisation and the ways to scale up a CSD

Settlement cycle

Lieve Mostrey, Chief Executive Officer, Euroclear Group

Lieve Mostrey, Chief Executive Officer, Euroclear Group Since January 2017, Lieve Mostrey has been Chief Executive Officer of Euroclear Group.

Ms. Mostrey joined Euroclear in October 2010 as Executive Director and Chief Technology and Services Officer of the Euroclear Group and an Executive Director of the Board.

Prior to Euroclear, Ms. Mostrey was a member of the Executive Committee of BNP Paribas Fortis in Brussels, where she was responsible for IT technology, operations, property and purchasing. Ms. Mostrey began her career in 1983 within the IT department of Generale Bank in Brussels, moving to Operations in 1997 and, upon its merger with Fortis in 2006, became country manager for Fortis Bank Belgium. She became Chief Operating Officer of Fortis Bank in 2008, which was acquired by BNP Paribas in 2009.

Ms. Mostrey was previously a Non-Executive Director of SWIFT, RealDolmen, Visa Europe and of Euroclear. She was until recently a member of the Supervisory Board of Euronext.

Lieve Mostrey is a member of several initiatives contributing to develop the financial sector:

Having earned a degree in civil engineering from Katholieke Universiteit Leuven in 1983, Ms. Mostrey completed a post-graduate degree in economics from Vrije Universiteit Brussel in 1988.

As a hobby, Lieve Mostrey enjoys playing golf.

Michael Bodson, President and Chief Executive Officer of DTCC

Michael Bodson, President and Chief Executive Officer of DTCC Michael C. Bodson is President and Chief Executive Officer of DTCC. He is also President and Chief Executive Officer of DTCC’s principal operating subsidiaries, DTC, FICC and NSCC, and a member of DTCC’s board of directors.

In his prior position as DTCC’s Chief Operating Officer, Michael had enterprise-wide responsibility for all Information Technology and Operations and oversaw DTCC Deriv/SERV LLC and EuroCCP. He previously served as Chairman of various DTCC subsidiaries, including Deriv/SERV and Omgeo.

Michael joined DTCC in 2007 as Executive Managing Director for Business Management and Strategy. Prior to this, he held a number of senior management positions with Morgan Stanley over a 20-year period. In his last position at Morgan Stanley, Michael was Global Head of the Institutional, Retail and Asset Management Operations department. He previously served as Divisional Operations Officer for the Institutional Securities Group and Head of the Enterprise Information Group. He served as Head of Finance, Administration and Operations for Morgan Stanley Japan in Tokyo, and prior to that, he held similar responsibilities for Morgan Stanley Asia in Hong Kong. Prior to joining Morgan Stanley, Bodson worked at Bear Stearns and Price Waterhouse.

Michael is a CPA and graduated Magna Cum Laude from Boston College. He currently is a member of the Federal Deposit Insurance Corporation (FDIC) Systemic Resolution Advisory Committee and is a Trustee of the World Economic Forum’s Financial Services Initiative. He previously served as a member of the Board of Digital Asset Holdings Initiative as well as the Federal Reserve Bank of New York Fintech Advisory Group.

Stephan Leithner, Member of the Executive Board of Deutsche Börse AG, responsible for Pre & Post-Trading

Stephan Leithner, Member of the Executive Board of Deutsche Börse AG, responsible for Pre & Post-Trading Stephan Leithner has been appointed as Member of the Executive Board of Deutsche Börse Group at the beginning of July 2018. He is responsible for the Group’s post-trading business (Clearstream), and pre-trading (ISS, Qontigo) businesses.

Stephan Leithner served as a Partner of the leading alternative investments firm EQT since 2016. Previously, he acted as a Member of the Management Board of Deutsche Bank AG from 2012 until 2015, where he had held a number of leadership positions in Global Banking since 2000. Further work stations include McKinsey & Company as well as the Swiss Institute for Banking and Finance in St. Gallen, Switzerland.

He has a PhD in Finance and a Master in Business Administration from University of St. Gallen.

Ulrich Bindseil, Director General, Market Infrastructure and Payments, European Central Bank

Ulrich Bindseil, Director General, Market Infrastructure and Payments, European Central Bank Ulrich Bindseil is Director General Market Infrastructure and Payments at the European Central Bank (ECB), a post he has held since November 2019. Previously, he was Director General Market Operations (from May 2012 to October 2019) and head of the Risk Management Division (between 2005 and 2008). Mr Bindseil first entered central banking in 1994, when he joined the Economics Department of the Deutsche Bundesbank, having studied economics. His publications include, among others, Monetary Policy Operations and the Financial System, OUP, 2014, and Central Banking before 1800 – A Rehabilitation, OUP, 2019.

Anna is Secretary General of the European Central Securities Depositories Association (ECSDA).

She is a lawyer by background and holds a Master in European law and a multidisciplinary Master in Law and Economics and is also trained in managing strategic projects by the University of Oxford Saïd Business School.

Anna combines an extensive post-trade knowledge with the policy-making experience. She started her career at the general secretariat of one of the political parties at the European Parliament. Then having worked in the Business Transformation and Service Excellence department of an ICSD as well as for their group in Strategy and Government Relations. She is leading the European CSD industry association since 2017.

Mark Gem has been with Clearstream for over 20 years and a board member since 2007, focusing on network management, primary markets activity and compliance. He was responsible for Clearstream’s T2S strategy. He currently chairs Clearstream’s Risk Committee, amongst many other things overseeing the post-Brexit organisation of Clearstream’s UK business and Clearstream’s overall response to the COVID-19 crisis. He represents Luxembourg on the boards of SWIFT and sits on the board of Regis-TR, the Luxembourg-based trade repository. He has been on the board of ECSDA since 2002 and served as Vice-Chairman under Joël Mérère until 2013. In May 2021, Mark was elected ECSDA Chair.

Mark has a first class degree from Oxford University in Modern History.

Graduated from the ESSEC business school Robert Ophèle joins the Banque de France in 1981 where he will make the largest part of his professional career in banking supervision, in developing and implementing monetary policy and in financial management of the bank.

Following a secondment to the Federal Reserve Bank of New York, he took up the position of Director of the Management Control and Budget Directorate, then was appointed Deputy Director General Economics and International Relations, before being promoted Director General Operations. He held the position of Second Deputy Governor of the Banque de France from January 2012 until July 2017; in this role he became a member of the Supervisory Board for the European Central Bank.

On 1st August 2017 he was appointed Chairman of the Autorité des marchés financiers.

This panel will allow CSDs to elaborate on their ESG projects and discuss with the government representatives their engagement on ESG and sustainable development goals. The speakers will also discuss the role of CSDs in helping to facilitate the flows of international investment capital in line with ESG objectives.

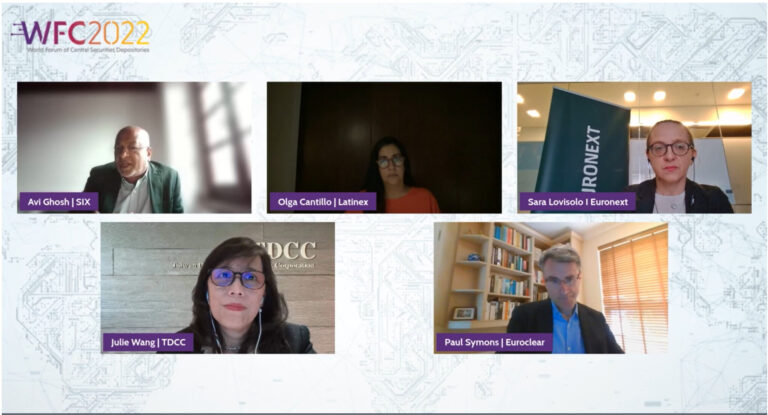

Avi has spent almost 40 years as a journalist, copywriter and marketing professional in India, UK, Belgium and Switzerland. Of that, the past 30 have been spent in the worlds of financial technology and financial services – first at SWIFT where he was responsible for marketing their securities services to the global financial community. And then as the Head of Marketing for SIX Securities Services (formerly know as SIS) in Switzerland. Today, he heads marketing for the Swiss Stock Exchange, The Spanish Stock Exchange the SIX Digital Exchange.

Olga Cantillo is the Executive Vice President and CEO of Latin American Stock Exchange (Latinex). She has over 30 years of professional experience in the financial services industry.

Ms. Cantillo is currently also President of the Ibero-American Federation of Stock Exchanges (FIAB), Director of the Central Securities Depository Association of the Americas (ACSDA), Secretary of the Association of Capital Markets of the Americas (AMERCA), Member of the Independent Advisory Committee of the UN Sustainable Stock Exchanges Initiative (SSE), Independent Director of BI-Bank Panama, and Director of Fundación Calicanto.

Julie is Head of Fund and Global Services Department in TDCC. In her role, Julie leads teams to provide custody service and fund administration services as well as promote international cooperation between Asian CSDs. In her prior role as Head of Issuer Services, she established the TDCC ESG service team in 2018 and launched TDCC Investor Relation Platform (TDCC IR Platform), the first public accessible ESG rating dashboard in 2019, effectively amplifying ESG awareness in Taiwan. The service has appeared in various publications, including Financial Times and Reuters.

Julie has more than a decade of experience in developing issuer services and led many notable products, including provision of e-voting services (2009), complete dematerialization of physical securities in Taiwan (2011), as well as provision of STP cross-border voting services for shareholders’ meetings (2014). She is a widely recognized advocate of corporate governance and frequently represent TDCC to speak about practical experiences in international conferences, including Asian Corporate Governance Association Conference and Sibos hosted by SWIFT.

Paul Symons is Group Chief of Staff forEuroclear SA/NV, providing advice and supportto the Euroclear SA/NV Chief Executive and theEuroclear SA/NV Management Committee. Hewas appointed to this role on 1 September 2020.

In addition, Mr Symons was appointed ChiefSustainability Officer for the Euroclear Group inSeptember 2021.

He also sits on the Board ofEuroclear UK & International (a wholly-ownedsubsidiary of Euroclear SA/NV) as a Non-Executive Director.

From 2018-2020, Mr Symons was the Head of theEuroclear SA/NV Corporate Secretariat Divisionand Secretary to the Euroclear SA/NV Board ofDirectors.

From 2002 – 2018, Mr Symons was Group Headof Government Relations at Euroclear,responsible for managing Euroclear’srelationships with those stakeholders whoinfluenced the regulatory and political context inwhich Euroclear operated.

He has been a boardmember of the European Central SecuritiesDepositories Association (ECSDA) and chairedthe Association’s Policy Group until March 2018.

He has also been a member of the EuropeanSecurities and Markets Authority’s (ESMA) Post-Trade Consultative Group, and a variety of otherEuropean post-trade Committees.

Mr Symons joined Euroclear in 2002, followingthe merger with CRESTCo (now Euroclear UK &International), the central securities depositoryfor UK securities.

Previously, Mr Symons spent seven years at theBank of England in a variety of roles, including aperiod working as the Private Secretary to theExecutive Director of the Banking Supervisionand Banking Departments.

He is a graduate of the University of Londonwhere he studied Medieval and Modern History.

Sara is responsible for sustainability managementand strategy at Borsa Italiana, part of LondonStock Exchange Group. She is also co-chair ofthe working group tasked with setting up thegovernment-backed Italian Sustainable FinancialCentre, following her involvement in 2016 in theItalian National Dialogue on Sustainable Financeas co-chair of the Capital Markets workinggroup.

She has been an active member of theConsultative Group of the UN-backedSustainable Stock Exchanges initiative since 2014,and in 2018 joined the Steering Committee ofFC4S, the UNEP-supported network of FinancialCenters for Sustainability. In June 2018 she wasappointed to the EU Technical Expert Group onSustainable Finance.

She has a Masters in Economics from BocconiUniversity and has co-authored a number ofpublications on the impact of taxation on the costof capital. She also has a post-graduatecertificate in Applied Anthropology from theUniversity of Milan-Bicocca.

Javier Hernani took up his role of Head of the Securities Services business unit and he is member of the Executive Board of Six Group, since January 2021, after the takeover of BME by SIX. He is also CEO of Bolsas y Mercados Españoles, Sociedad Holding de Mercados y Sistemas Financieros, SA, since April 2017. He served as General Manager of BME from December 2012 to April 2017, with the specific role of coordinating the action of business units and corporate areas. Chairman of the Risk and Security Committees as well as Member of the board of several subsidiaries. Previously, he joined BME as Chief Financial Officer and member of the Executive Committee, assuming the role of conducting the integration process of the newly created group and leading the IPO process which took the company public as of 14th July 2006.

Prior to its incorporation to Bolsas y Mercados Españoles, Mr. Hernani was Deputy General Manager of the Bilbao Stock Exchange (until 2003), CFO of Norbolsa, S.V.B. (until 1998) and Consultant in Coopers & Lybrand Brussels (until 1989).

Mr. Hernani earned a Degree in Economics and Business by University of Deusto in 1986, a Master’s Degree in European Economic Studies, specialising in Economics, by The College of Europe in Brussels in 1988 and a Master’s Degree in Advanced Management by University of Deusto in 1997.

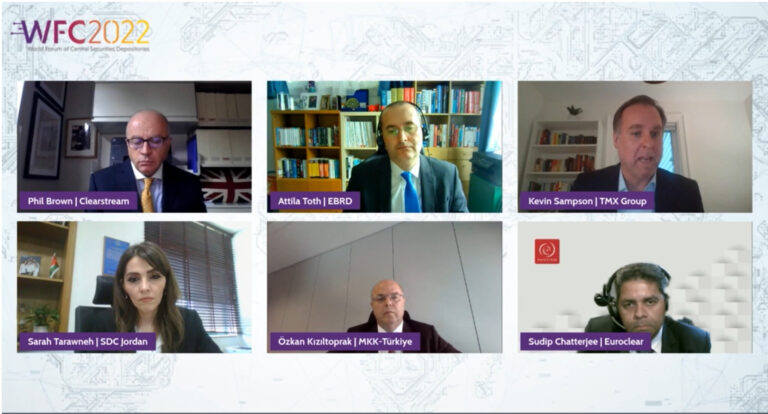

The panel will discuss the impact of the cross-border activity of CSDs on the local and global economies.

Philip Brown is Chief Executive Officer of Clearstream Holding AG and Head of Global RM, Sales and Client Services. He moved to his current position from the London office in 2008, where he was General Manager and Headed Client Relations for United Kingdom, Ireland, Nordic and the Americas. He joined the company in July 2005 after twelve years in the custody and clearing business, in a variety of front office sales and relationship management positions. Prior to joining Clearstream, he spent 7 years at The Bank of New York, latterly as Managing Director and Head of European Sales, 2 years at Morgan Stanley International and 7 years at Barclays PLC. He holds a degree in Banking, Insurance and Finance from University College North Wales, Bangor.

Attila Toth is working for EBRD as Principal in the Capital & Financial Market Development Team since 2018. He is specialized in equity capital market and capital market infrastructure development where he built up a 20-year experience. He started his career at the Hungarian Debt Management Agency in 1997 and joined the Budapest Stock Exchange in late 1999. During his 16-year career at the BSE he was responsible for business and product development, trading and post-trading. Between 2008 and 2016 he was the Deputy CEO of the stock exchange responsible for issuer and trading member relations, product development, trading and business strategy. He was chairman of the Supervisory Board and also the member of the Board of Directors of the Central Depository and Clearing House of Hungary. He took part in international capital market development projects and spent years in the corporate finance and private equity industry specialised for SMEs before joining the EBRD.

Attila is highly devoted to the improvement of financial literacy. He was the Chief Secretary of the Foundation for Financial Self-Awareness, an institution founded by the Budapest Stock Exchange and later the member of the Board of the Money Compass Foundation of the National Bank of Hungary. Attila Toth has a Master Degree in Finance from the Budapest Corvinus University and has a EFFAS/ACIIA International Programme of Investment Analysis Diploma.

Mr. Sampson is President of CDS. Kevin has over 20 years of capital markets experience managing high-performing teams across multiple functions and business areas, including sales and business development, operations, customer support and product development. His collaborative, client-centric approach has enabled Kevin to achieve positive business results while building long-term, trusted relationships with peers and stakeholders across the industry. Most recently, Kevin was President, Equity Trading for TMX Group Inc. where he managed the trading businesses of Canada’s premier equity exchanges (Toronto Stock Exchange, TSX Venture Exchange and TSX Alpha Exchange).

Sudip Chatterjee is Head of Global Capital Markets at Euroclear. Mr.

Chatterjee is responsible for defining and designing the vision and

strategy, along with aligning all business initiatives across the global

capital markets.

In this capacity, Mr. Chatterjee leads the discussions and partners with

market authorities and regulators in local and international markets

across the world, with the objective of designing solutions that help

market liquidity and borrowing costs, resulting in a stronger

macroeconomic climate and sustainable development.

Mr. Chatterjee has constant dialogue with multilateral financial

institutions, including the World Bank, IFC, European Bank for

Reconstruction and Development and Inter-American Development

Bank. He also maintains relationships with other key capital market

entities, including rating agencies, index providers and the leading

global fund and asset managers, to ensure alignment and facilitate

the sustainable growth of the global capital markets.

Prior to his current role, Mr Chatterjee held a number of senior positions

within Euroclear, including Head of Primary Markets of Product &

Strategy, Head of International Markets in Network Management and

Head of Process Change Management. Prior to joining Euroclear, Mr.

Chatterjee was a management consultant, advising organisations, such

as Bank of America, Axa and Eurocontrol.

Mr. Chatterjee has a degree in Civil Engineering and a post-graduate

degree in Management .

received his bachelor’s degree from İstanbul University’s International Relations Department at the Faculty of Economics.

He started his carreer at Citibank in 1995 working in the treasury and securities operations then moved to AFinance Plc Dublin in Ireland as the country manager for three years.

He re-joined Citibank in 2002 and managed securities services, treasury, cash services, import and export and brokerage operations as the group manager until 2018.

During his tenure at Citibank he successfully led many local and international projects and took active roles in the Banks Association, Takasbank and MKK working groups.

The integration of SWIFT messaging between Takasbank, MKK and intermediary institution, establishing capital gain tax processes on securities transactions,

implementation of securities dematerialization process, holding fixed income instruments at beneficial owner level at MKK and

elimination of “three zeros” from securities nominals are some of the critical projects that he led.

Before joining MKK he worked at few of the major capital markets solution provider companies where he managed business and product development,

operational excellence and project management units in addition to advisor and trainer roles.

He holds Capital Markets Level 3 and derivatives instruments licenses as well as business intelligence tools certificates.

Mr. Kızıltoprak assigned as the Executive Vice President responsible for Market Operations at Merkezi Kayıt Kuruluşu A.Ş. on 07.10.2020.

Sarah Tarawneh is the Chief Executive Officer of the Securities Depository Center of Jordan (SDC), she has been working with the SDC for over 17 years, during which she was responsible of multiple managerial tasks, including public relations, custody business, drafting rules and regulations, her previous role was director of the Legal Affairs, prior to being appointed the Chief Executive Officer early this year.

Sarah also served on the board of ANNA (Association of National Numbering Agencies) for the term of three years (2019-2021) dedicated to supporting the industry of standardization in capital markets in the region.

Sarah is specialized in Capital market legislation, Depository, Clearing and settlement, compliance with international standards and best practices.

She holds a Bachelor’s degree in Law from the University of Jordan, and a license of practice from the Jordanian Bar association; she also attained many professional training and certificates in financial services field.

The panel will discuss the importance of cross-border convergence in post-trade, current externalities of national legislations and principal post-trade areas where the global convergence would be beneficial for deeper global integration of capital markets.

Guillaume Eliet has been Chief Executive Officer of Euroclear ESES CSDs (Euroclear France, Euroclear Belgium and Euroclear Nederland) since 01 September 2021.

Mr. Eliet was head of Regulatory, Compliance and Public Affairs, for Euroclear group Since 2017.

Prior to joining Euroclear, he worked at the French Stock Market Authority, the Autorité des marchés financiers (AMF), where he was the Deputy General Secretary, heading the Regulation Policy and International Affairs division. Guillaume had previously been head of the Asset Management division within the AMF in Paris.

A lawyer by profession, Mr. Eliet graduated with a postgraduate Diploma in Business Law and Taxation, as well as a Master’s Degree in Business Law at Sorbonne University.

John Siena, based in London, is Associate General Counsel, Co-Head Global Regulatory Strategy, for Brown Brothers Harriman (BBH), a New York-headquartered financial services provider with operations world-wide. John recently for many years has lectured on financial services law at Leiden University, The Netherlands, and King’s College, London, well as in Ireland’s Certified Investment Fund Director Institute. John recently has co-written the book, Financial Collateral, published by Oxford University Press (2020), and contributed to The Alternative Investment Fund Managers Directive, Wolters Kluwer, 3rd Ed. (2020).

John chairs the Association of Global Custodians – European Focus Committee (AGC-EFC) and in this capacity represents the custody industry to EU, national and global competent authorities and supervisory bodies in connection with all post-trade and related matters. John sits on cross-industry steering and working groups as well as the European Central Bank’s new Corporate Events Group (CEG) and the American Bar Association’s Business Law Section Task Force on Securities Holding Infrastructure. Recent focus has been particularly on digital ledger technology and cryptoasset regulation and law on the post-trade sector in the EU, UK the U.S. and Japan.

John formerly was Head of Asia Legal at BBH; Head of External and Regulatory Affairs, EMEA, at BNY Mellon; Assistant General Counsel, EMEA, at Brown Brothers Harriman; and Senior Legal Counsel at The Northern Trust Company.

John is admitted to the Illinois Bar (1988).

Gesa Johannsen is Global Head of Product Strategy for Clearance and Collateral Management Business at BNY Mellon. In addition, she is the EMEA Head of Clearance and Collateral Management Business. She joined BNY Mellon in 2013 as a leader in the product management for the Collateral Management Business.

In her capacity as Global Head of Product Strategy, Gesa leads the business and platform strategy for the triparty collateral management business, with a collateral franchise of more than $4 trillion assets on the platform, as well as the Global Clearance Business of BNY Mellon. Her product strategy team drives the business strategy as well as the product implementation roadmap with technology.

Gesa is a key leader in the Clearance and Collateral Business and was appointed the EMEA Business Head in September 2020. Since then, she is responsible for driving growth in the EMEA region where she leads the sales and relationship management team as well as the governance & controls team. In her role as EMEA Business Lead, Gesa maintains critical oversight of the business’ regional regulatory obligations, operating in BNY Mellon SA/NV and the BNY Mellon London Branch.

Gesa has over 25 years industry experience. Prior to joining BNY Mellon in 2013, she worked at Eurex Clearing, Europe’s largest central counterparty clearing house (CCP), where she was Head of Derivatives Clearing Business Development and with responsibility for the Business and Product Strategy of the clearing house across listed and OTC-Derivatives. Through her role at Eurex Clearing, she has extensive experience in collateral management and segregation solutions for centrally cleared products. Gesa has also previously held senior roles at KPMG and Deutsche Bank.

In addition to her executive leadership roles in the Clearance & Collateral Business, Gesa has joined the Board of ISDA (International Swaps and Derivatives Association) in January 2021, taking an active role to support ISDA’s strategic goals to foster safe and efficient derivatives markets.

In Europe, Gesa represents BNY Mellon in the Eurosystem Advisory Group on Market Infrastructures for Securities and Collateral where she is Chair of the Collateral Harmonisation Task Force for Europe. She has happily taken the lead for this mandate as she is passionate about the European Capital Markets Union project and has been actively involved in cross-industry working groups with European regulators for many years.

Gesa is passionate about BNY Mellon’s Diversity and Inclusion agenda and is the Co-Lead for GenEdge Germany as well as a member of the Women’s Initiative Network. Gesa is engaged in mentoring of next generation executives within BNY Mellon and the financial services industry.

Gesa is an economics and business graduate of the University in Cologne, Germany. She is based in Frankfurt, playing a global role in the Clearance and Collateral Management Business. She is mother of two wonderful girls, ages 13 and 16. As time permits, she is passionate about outdoor sports such as Mountain-Biking, Hiking and Skiing.

Takeshi is Deputy Head of the Secretariat of the Committee on Payments and Market Infrastructures (CPMI). As Deputy Head, he supports CPMI parent committee and represents the CPMI at various international groups.

Before joining the BIS, he served as chief representative in Frankfurt of the Bank of Japan (BoJ) from 2014 until 2016. At the BoJ he spent many years in the areas related to financial market infrastructures (FMIs). His work included BoJ’s FMI policy and oversight issues regarding Japanese and international FMIs. He represented the BoJ at various FMI-related international groups and cross-border cooperative oversight arrangements.

He also led the BoJ’s supervisory team for Japanese banks and broker dealers. He represented the BoJ at supervisory colleges and crisis management groups for G-SIFIs.

Earlier in his career he was a junior representative at the BOJ Frankfurt office. From 2008 and 2010 he was seconded to the BIS as a member of the CPSS Secretariat. He studied law at Kyoto University and economics at University of Göttingen.

Juan Alfaro joined Financial Superintendency of Colombia (SFC) in 2015 as Deputy Superintendent for Risk Supervision. In 2017, he assumed as Deputy Superintendent for Capital Markets responsible for the supervision of the functioning of securities markets and the asset management industry in Colombia.

Prior to joining SFC, Juan Alfaro worked in Fondo Latinoamericano de Reservas (FLAR) for 14 years as Chief Risk Officer, responsible for overseeing the overall asset and liability management strategy, the formulation financial risk policies and ensuring the compliance with the risk management framework.

From 1995 to 2001, he worked at the Banking Superintendency of Colombia, where he participated in the teams in charge of the adoption of the Basle II Capital Agreement and in the design of new regulation for treasury activities and risk management for the Colombian banking industry.

Juan holds a MSc. in Finance from London Business School and a BS in Industrial Engineering from Universidad de los Andes in Bogotá Colombia.

Jasmine Ma, senior manager of Strategy and Development Department, China Securities Depository and Clearing Corporation. She joined CSDC in 2013 after she graduated from Peking University, holding a master degree in English Literature. She has been engaged in international business of CSDC and ACG affairs over the years.

Abdulla Abdin has Masters in Business Administration from the University of Glamorgan UK, and currently holds the position of Chief Operating Officer– Bahrain Clear. He is the Chairman of the Guarantee Fund Committee and Chairman of the African Middle East Depositories Association (AMEDA). Mr. Abdin has over 31 years of experience in Banking and Capital Market structure, regulations and operations.

Anna is Secretary General of the European Central Securities Depositories Association (ECSDA).

She is a lawyer by background and holds a Master in European law and a multidisciplinary Master in Law and Economics and is also trained in managing strategic projects by the University of Oxford Saïd Business School.

Anna combines an extensive post-trade knowledge with the policy-making experience. She started her career at the general secretariat of one of the political parties at the European Parliament. Then having worked in the Business Transformation and Service Excellence department of an ICSD as well as for their group in Strategy and Government Relations. She is leading the European CSD industry association since 2017.

Based in Colombia, Bruce Butterill is the Executive Director of the Americas’ Central Securities Depository Association (ACSDA). He is also an independent Capital Market Infrastructure consultant, and has worked on engagements with Securities Depositories, Clearing Corporations and Stock Exchanges in in 17 countries across the globe.

Prior to becoming a consultant Bruce spent 19 years with CDS, the Canadian Depository for Securities, where at various times was the senior executive responsible for national operations and the product management/development functions.

Arman Melkumyan has more than 11 years of experience in the financial industry. Mr. Melkumyan is an expert in the financial markets; client, government and international relations; new business processes development and implementation.

Starting October 2018 Mr. Melkumyan assigned as Secretary General of the Association of Eurasian Central Securities Depositories (AECSD). Being the Secretary General the main scope of work is

· Planning and coordination of the activities of the Association

· Organization and holding of events (conferences, seminars, training webinars, working groups, committees)

· Conducting research in various areas

Mr. Melkumyan is a member of different working groups of World Forum of CSDs (WFC) and leading the development of E-learning platform (https://aecsd.org/en/e-learning/) – one of the initiatives of WFC for CSDs’ knowledge exchange.

Manmohan Singh is a senior economist with the IMF. He writes extensively on topical issues including collateral velocity (a term he coined), rehypothecation of collateral, monetary policy and collateral, role of global custodians, and why some EM collateral should be part of global plumbing, and (recently) digital money, stablecoins and access to central bank reserves. His new book, Collateral Markets and Financial Plumbing, looks at all the above topics from the lens of financial collateral. Manmohan has led workshops for the IMF to official sector policy makers on the impact of regulations on financial markets. He holds a Ph.D. and M.B.A. from University of Illinois at Urbana-Champaign and a B.S. from Allegheny College. His recent articles are available at https://sites.google.com/view/msinghdc/home

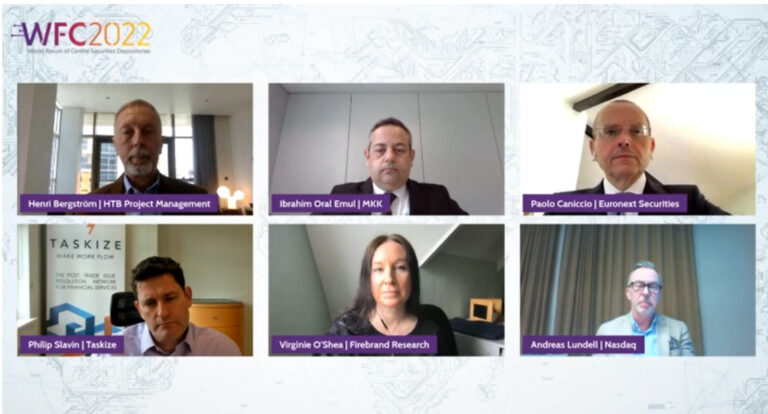

Topic: Setting the vision on the use of technology by the financial industry

The panel will explore the use of innovative technologies and showcase CSD projects

Key competences, capabilities and interests

· Development of emerging capital markets; corporate structure, management processes, market and post trade structures and offering, mergers and acquisitions, ESG and sustainability

· Fintech strategies

· Business development processes

· Acquisition strategies and integration deliveries

· Technology migration

Current position

Managing Director and Chairman of HTB Project Management FZE, Dubai UAE. Company focuses on

· Development of frontier and emerging capital markets including building corporate, market infrastructure and business strategies, development of business opportunities and lines as well as building fintech and digitalization strategies

· Re-engineering post trade structures (CCP and CSD) and business models

· Development and enhancement of sustainable and ESG securities business and market offering

· Delivered multiple advisory and consultancy assignments in the GCC region

Speaker and thought leader

Frequent speaker in global conferences and events. In the past many years Henri has for example been speaking, moderating or participated in panel discussions in these occasions in all continents.

Addition to speaking Henri has written articles in industry papers such as for ISS Magazine, MondoVisione and Banking Technology as well as writing his own post trade related blog as part of Nasdaq public communication.

Countries of operations

For the past 30 years Henri has been responsible for accounts, prospects and high-level relationships in dozens of countries. Main regions have been Gulf area, Central and Southeast Asia, Africa and Latin America.

Graduated from Control and Computer Engineering, Istanbul Technical University (1993) and Executive MBA, Melbourne RMIT University (2012), received PMP certificate in 2010.

After Accenture Australia, he established the Directorate of Business Intelligence at Turkish Airlines, and managed the Data Warehouse, ETL, Business Intelligence, Reporting, Large Data, Advanced Analytical, Business Analysis teams. After this role, he managed CRM and Digital Business Development Departments consequently. In April 2021, joined Central Securities Depository of Turkey (MKK) as Director of Business Intelligence, Data Management and Corporate Solutions.

He has extensive IT knowledge and work experience in different sectors. Throughout his career, he built, shaped and managed large number of new units, developed and implemented long-term strategies, implemented technological and digital transformations, successfully managed high-budget projects, and made important deductions in high-cost processes.

Has broad experience in ERP, CRM (Customer Relations, Sales, Service and Call Centre), Data Integration and Management, Business Intelligence (DWH, ETL, ODS, Large Data, Reporting, Dashboard, UX, Analytical, Artificial Intelligence). Took part in Process Automation, Process Improvement, Project Management, Technical and Business Analysis, Software Development, Digital Transformation, R&D, Innovation, Lean Management, Cloud Solutions, Application Development, Testing and Support processes. Acted as mentor, trainer and speaker in many programs.

Andreas Lundell is the Head of Product for Nasdaq’s CSD technology offering at Nasdaq Market Technology, responsible for developing the long-term vision for Nasdaq’s CSD technology product portfolio, while leading a team of post-trade technology professionals in their work to ensure high-quality and efficient delivery of CSD solutions tailored for the needs of tomorrow. Andreas is based in Stockholm, Sweden and has over 20 years of experience in the post trade industry. Prior to joining Nasdaq in 2015, Andreas held various position within Euroclear Sweden

Virginie O’Shea is a capital markets fintech research specialist, with two decades of experience in tracking financial technology developments in the sector, with a particular focus on regulatory developments, data and standards. She is the founder of Firebrand Research, a new research and advisory firm focused on providing capital markets technology and operations insights for the digital age.

Most recently, she was a research director with Aite Group, heading up the Institutional Securities & Investments practice and covering data management, collateral management, legal entity onboarding, and post-trade technology. In this role she spearheaded strategy for the practice and managed a team of eight analysts across the globe.

Ms. O’Shea has spoken at industry conferences including Sibos, TradeTech, FISD events, and The Network Forum, and is actively engaged in a number of post-trade industry standards groups.

Prior to Aite Group, she was managing editor of A-Team Group’s flagship publication, A-Team Insight, where she covered financial technology from the front to back office, including trading technology, market data, low latency, risk management, regulatory impacts on IT, and reference data. During her time at the firm, she was heavily involved in planning risk and data management events and creating multimedia offerings, including podcasts, webinars, and video interviews. Prior to this, Ms. O’Shea was group editor of Investor Services Journal and Alternatives magazine, focused on the asset servicing and buy-side communities. Before that, she was editor of STP Magazine and online service stpzone.com, where she focused on financial technology in the capital markets.

Ms. O’Shea holds a Master’s degree in English Literature from the University of Edinburgh.

Philip Slavin is Co-Founder and Chief Executive Officer of Taskize. Phil has spent over 25 years as both a user and a creator of financial technology. For the early part of his career, he worked with both buy and sell-side institutions building and deploying banking solutions and running large change management programs. In 1999 he joined Fidessa, a market leading trading software house, where he ran Business Development and Product Marketing building electronic and algorithmic trading solutions across existing and emerging global exchanges. Immediately prior to starting Taskize, Phil led Strategic Alliances in EMEA for Pivotal Software, a specialist in agile software delivery. His belief is that by building sensible solutions you can remove complexity from the system to create tangible, competitive advantage

Paolo, as a Post Trade Technology Services CTO of the Euronext Group, has the responsibility of the IT organizations of the 4 CSD – Euronext Securities Porto, Oslo, Copenhagen and Milan – and of the CCP – Euronext Clearing -.

He spent more than 20 years working in the FMI world, recovering managerial roles in Monte Titoli, where he was appointed as a CTO in 2017 and in the LSEG, where he covered the role of the CIO for the Post Trade Italy Division.

This panel will showcase the new and advanced market infrastructure DLT projects. Presenters will capture your attention with an eye-opening description of the brightest new projects and provide an update on the current phase and solutions to challenges of the previously presented DLT Market infrastructure endeavours. Presenters will be able to take questions from the audience.

Francisco Béjar is Head of the CSD Services of SIX BME group.

Mr. Béjar has 29 years of experience in post-trading, mainly in areas such as Settlement and Custody, Cash and Treasury and Corporate Trust, from a double point of view, as custodian and as market infrastructure. He is member of the Executive Committee and Board of Directors of ECSDA (European Central Securities Depository Association), and member of various market committees and expert groups at national and international level, such as the Clearing, Settlement and Registration Experts Group chaired by the CNMV (Comisión Nacional del Mercado de Valores), the Post-Trading Standing Committee´s consultative Working Group of ESMA (European Securities and Markets Authority), the Harmonisation Steering Group chaired by the ECB (European Central Bank)

Angus is co-founder and Chief Executive of Artclear Ltd, a technology firm that is building trust and transaction management infrastructure for the global art market.

Before moving full time to Artclear, Angus was Head of Product at CLS, responsible for its core service that settles over US$6 trillion of foreign exchange transactions every day, as well as for new product launches. Prior to that he was Head of Product Strategy and Innovation at Euroclear,, where he led the Group’s early engagement with distributed ledger technology as well as its investments in Fintech firms.

Angus started his career in the strategy team at the London Stock Exchange and worked in a variety of strategy, product and change management roles at Accenture and HSBC Securities services.

Alongside his work in market infrastructure, Angus has served as a member of AMI-Pay, the ECB’s market advisory group for Payment Infrastructures, and the Bank of England’s Chaps Strategic Advisory Forum. He was also a member of the European Securities and Markets Authority’s Consultative Working Group in Innovation. He holds a degree in history from the University of Leeds.

Inmaculada Navas joined SDX in April 2019 as Head of Legal and Compliance, with a mandate to lead the FINMA licensing approval proceedings, build a legal and regulatory framework, legal advisory for products and initiatives, manage external counsel mandate and build an internal legal team.

Inmaculada has over 18 years of long-standing Legal and Compliance experience partnered with Leadership and Project Management skills gained from a solid work history in the private sector.

Prior to SDX, Inmaculada worked in UBS and Credit Suisse, where she gained expertise in cross-border matters and international law related to financial markets, banking law, financial crime, regulatory affairs, governance, litigation and enforcement.

Jens Hachmeister, Managing Director at Deutsche Börse AG is its Head of Issuer Services and New Digital Markets and a member of the Clearstream Management Board. After completing a banking apprenticeship and a degree in business administration, he began his career as a management consultant at KPMG before joining Xetra Market Development at Deutsche Börse AG in June 2000. As Head of Operations and Infrastructure Development in the Xetra division, Jens was part of the Management Committee Xetra until January 2009. From mid-April 2010 to December 2015, he was the Chief HR Officer of Deutsche Börse AG and in mid-August 2015, he assumed the newly created role of Chief of Staff and Head of Strategic Execution to the Group’s CEO. As of April 2018, Jens created the New Digital Markets Area as one of the key pillars of Deutsche Börse’s DLT and blockchain strategy before taking on additional responsibility as Clearstream’s Head of Issuer Services in February 2020.

Tim Hogben was appointed Group Executive of ASX’s Securities and Payments and CHESS replacement project in October 2020, assuming overall executive responsibility for delivery and governance of ASX’s highest profile project.

Tim joined ASX in 2000 and has extensive markets experience, strong industry relationships, and a thorough understanding of the operational, technical, customer and regulatory complexities that drive trading, clearing and settlement. He has been involved in the CHESS replacement project since its inception and has experience in service delivery, operational workflows, system development, control environments and in leading multi-faceted projects.

During his time at ASX, Tim has held a number of general management roles at ASX, including Executive General Manager of Operations, and most recently served as Chief Operating Officer from January 2017, where he had overall responsibility for the live service environment at ASX, including compliance with licensing conditions, execution of the organisation’s business strategy and delivering service excellence to customers.

Tim is passionate about workplace culture and diversity and creating an inclusive environment where people are challenged to be and do their best. Tim also serves as the Executive Sponsor for ASX’s Culture&Heritage employee networking group.

Mr. Rahul Pratap Singh is leading business and products for issuer services of NSDL since February 2020, He is a seasoned financial services professional with demonstrated history of working in capital markets industry. Skilled in sales, customer relationship management, equities. Strong business development mindset with a Masters in Business Economics (Finance) and Bachelors in Business administration (Systems).

In a career spanning nearly two decades he has worked on streaming operations for Private wealth management and portfolio management services.

In his previous assignments he has been recognized for operational excellence and strong commitment to execution of tasks given.

DETAILED EXPERIENCE

Prior to Centrum wealth he has worked with Barclays wealth, Birla Mutual Fund, MF Global (Phillip Capital) & Sharekhan where he has worked on portfolio management services operations, trust services accounting, heading PMS dealing desk, managing operations for loan against shares (LAS).

Education:

The panel will discuss how to bring alternatives to the cash leg on the CSDs DLT platforms. What are the options available? What partnerships are needed and how to ensure the finality of DVP settlement on the chain and off the chain?

Mark Gem has been with Clearstream for over 20 years and a board member since 2007, focusing on network management, primary markets activity and compliance. He was responsible for Clearstream’s T2S strategy. He currently chairs Clearstream’s Risk Committee, amongst many other things overseeing the post-Brexit organisation of Clearstream’s UK business and Clearstream’s overall response to the COVID-19 crisis. He represents Luxembourg on the boards of SWIFT and sits on the board of Regis-TR, the Luxembourg-based trade repository. He has been on the board of ECSDA since 2002 and served as Vice-Chairman under Joël Mérère until 2013. In May 2021, Mark was elected ECSDA Chair.

Mark has a first class degree from Oxford University in Modern History.

Robert Palatnick is a Managing Director and Global Head of Technology Research and Innovation at DTCC, where he has responsibility for driving technology innovation at the firm and leads a number of key technology initiatives, including cloud, automation, machine learning, big data analytics and distributed ledger technologies. He is also responsible for collaboration with clients, regulators, fintech vendors and academia to research and advance technology innovations across the financial services industry.

Prior to this role, Rob served for over a decade as Chief Technology Architect, overseeing the firm’s global IT strategy, architecture, standards and engineering design of the systems and applications that support the firm’s broad range of products and services. During his career at DTCC, Rob also served as an Application Development Domain Lead, Chief Administrative Officer of IT and CIO of FICC. Prior to joining DTCC, Mr. Palatnick was Vice President, Development and Systems, at Security Pacific Corporation Sequor Software Services.

An active technology voice in the industry, Rob has been a featured guest speaker at key conferences worldwide and is often quoted in the press. He currently serves as Chairman of the Governing Board of the Linux Foundation’s Hyperledger Project, a collaborative effort to establish, build and sustain an open, distributed ledger platform across industries.

Rob received his BS in Electrical Engineering from the University of Buffalo and is an alumnus of the David Rockefeller fellowship.

Vipin Y.S Mahabirsingh holds a B.Tech (First Class, Hons.) degree in Electronic Engineering from the University of Mauritius, an M.Phil in Microelectronic Engineering and Semiconductor Physics from the University of Cambridge and an MBA (with distinction) from Edinburgh Business School, Heriot Watt University. He joined the Central Depository & Settlement Co. Ltd at its inception in 1996 as Systems Manager and was appointed General Manager in July 1997.

He was then appointed as Managing Director in November 2005. In his capacity as Managing Director of CDS, he also provides consultancy services to African stock exchanges and central depositories. He was the systems vendor’s Project Director in the implementation of trading and depository systems at the Nairobi Stock Exchange (2004/2006), Bank of Ghana (2004), Dar es Salaam Stock Exchange (2006), Botswana Stock Exchange (2008/2012), Lusaka Stock Exchange (2008) and Bolsa de Valores de Mocambique (2013). He supervised the implementation of an automated trading system at the Zimbabwe Stock Exchange in 2015 and has spearheaded the replacement of the trading and depository systems at the Lusaka Stock Exchange which went live in December 2017.

He is a member of the Technical Committee that has been set up by the African Stock Exchanges Association (ASEA) to drive the implementation of the African Exchanges Linkage Project (ALEP). He is also a member of the Ratings Committee of CARE Ratings Africa. Vipin has been appointed as member of the Product Advisory Committee (PAC) of the Digital Token Identifier Foundation (DTIF). DTIF’s mission is to provide the golden source reference data for the unique identification of digital tokens based on ISO’s new standard for digital assets, ISO 24165.

Isabelle Delorme is Managing Director, Global Head of Capital Markets and Issuer Access services.

She joined Euroclear in April 2019, as Chief Business Officer of ESES and sponsor of the Strategy, Product development, Innovation and Commercial dimensions. Among other projects, she took responsibility of the new shareholder identification product launch, the digital transformation of ESES communication tools and the ‘Central Bank Digital Currency’ experimentation.

Engineer by background, Isabelle, started her career in 1996 at Bouygues Telecom where she held the roles of Project and Marketing Manager, working on network rollout, product development in the B2B markets and finally managing the technical and operational integration of a newly acquired company, Club Internet.

As of 2008, she joined Allianz Trade where, after 3 years, she moved from Head of Marketing to Group Marketing & Product Management Director across 40 countries. Going through the global financial crisis, she took actions entailing the retention of clients while reducing risk-exposure, the acceleration of product innovation and the positive increase in the company’s reputation.

As of 2015, Isabelle moved to Allianz Partners and took charge of the Group Marketing & Products leadership, contributing to the restructuring of the Group, before becoming Sales Director France & Southern Europe in 2016. In this role, she was in charge of a book of more than 1 billion euros B2B insurance business.

A former Banking Executive with 22+ years of experience, including most recently Global Head of Product Management for Transaction Banking at Deutsche Bank, Rhom has developed an interest in creating digital businesses for finance and finance related areas. He brings experience of working across a wide variety of wholesale banking businesses and functions including sales, trading, product management, and technology to his role at Fnality. The majority of his experience has been developing businesses where the product is at the intersection of finance and technology.

Oliver Sigrist is an Adviser at the Bank for International Settlements Innovation Hub (BISIH). He is working on the use of novel technologies in central banking and is an expert on CBDC. Oliver was involved in projects Helvetia and Jura, which were realised in cooperation with the Swiss National Bank (SNB) and additional partners. Before joining the BISIH, Oliver was a senior economist at the SNB and a visiting fellow at the Sveriges Riksbank. Oliver holds a PhD in economics from the University of Basel.

The panel will update the audience on the latest developments in FMI cyber resilience.

Clearstream CISO and Head of Information Security Second Line of Defense since 2017. Global responsibility for information security governance, risk management, and compliance. Nejib leads organizational efforts for cyber resilience and related engagements at the ecosystem level.

Nejib also served as Senior Manager at PwC North America and Europe in their cyber and technology risk assurance practices. Prior to PwC, Nejib worked for several years in the Aerospace & Defense sector leading worldwide corporate deliverables in relation to cyber security, IT risk management and compliance.

Jim manages the Global Network Management (‘GNM’) division at TM and has over 26 years in the financial services industry. His responsibilities include running a team of 25 analysts and network managers who track custodian and market practice in 104 markets and assess risks in over 300 custodians, 145 CSDs and 27 CCPs worldwide. Jim is a subject matter expert on post-trade infrastructure and has led various strategic consulting projects on market infrastructure. Previously, Jim was a senior analyst within TM Network Management evaluating and selecting local and global custodians for clients as well as supporting a variety of consultancy engagements. Prior to joining TM in 1995, he was at Taylor Nelson Sofres as a Project Supervisor in their Financial division.

Jason Harrell, Managing Director and Head of External Engagement, leads DTCC’s global advocacy and engagement for cybersecurity and cyber resilience, new and emerging technology, and outsourcing / third-party risk management. In this role, Jason partners with industry peers, supervisors and regulators, international standards-setting bodies, government officials and trade associations to address policy initiatives and implement solutions that improve the overall resilience of the financial services sector. Jason contributes to a number of global trade association cyber and operational resilience working groups and is currently Vice Chairman of the Cyber Risk Institute, a non-profit coalition of financial institutions and trade associations focused on aligning cyber risk frameworks to supervisory cyber obligations. A thought leader and expert on cyber security and operational resilience, Jason often speaks at conferences, authors position papers and works to advance dialogue across the industry.

Jason joined DTCC in 2016 as the Head of TRM Risk Analysis and Reporting where he was responsible for the firm’s cyber risk assessment and performance metrics programs. Prior to DTCC, Jason was the Corporate Senior Information Risk Officer for BNY Mellon Investment Management. He previously held several information technology and security positions within IT, Risk and Business Operations at ABN AMRO, Royal Bank of Scotland and the New York Board of Trade.

Jason has over 20 years of experience in Information Technology (IT), Privacy, and Cybersecurity Risk Management within the financial services sector. He also holds several certifications in technology, information security and data privacy.

Manoj currently serves as the Senior Vice President & CISO for National Securities Depository Limited (NSDL) India. In this role, he is responsible for establishing Systems & security strategy and direction for the organization, provide leadership for key program through strong working relationships and collaboration across financial services industry ecosystem and keep current on emerging technologies, risks, and other related developments.

Prior to the current role, Manoj used to head the Information Security Globally for HCL Technologies and its affiliates where he built various programs on security, compliance and risk management for the enterprise. Earlier, he had served in Technology and Security leadership roles in various organization during his career.

Manoj is an active member in various industry forums and also has been associated with initiatives of industry and regulators. He is an active member of several global forums and regularly speaks in various events. He has a master’s in computer engineering and holds several industry standard certifications.

Olivier Dazard is heading the ‘Controls, Programme Evolution and Engagement team’ at SWIFT. This team drives the Evolution to the Customer Security Control Framework (CSCF) and Independent Assessment Framework (IAF) which are the heart of the Customer Security Program (CSP) at SWIFT; CSP helps financial institutions ensure their defenses against cyberattacks are up to date and effective.

Before joining the CSP program in 2016, Olivier was a Lead IT internal auditor for over 10 years involved in many engagements. He was also leading the Service Bureau inspections program at SWIFT. Olivier has been involved in many other IT functions during his 30+ years career at SWFT

Olivier holds a degree in Computing sciences from the University of Namur (Belgium) and is CISA certified.

Anthony Attia is Global Head of Primary Markets and Post Trade. In this capacity, he oversees Euronext’s Equity, Debt and Fund listing franchise and the Corporate Services business, as well as Clearing, Custody and Settlement activities at Group level. This includes direct responsibility for Euronext Securities regrouping four European CSDs and Euronext Clearing, the Italian Clearing House. Prior to that, Mr Attia also served as Chairman and CEO of Euronext Paris from 2014 to 2021.

In 2016, he was appointed Global Head of Listing, in charge of IPOs as well as the development of business with Euronext listed companies across Europe. Key successful initiatives include the launch of a European Tech Leaders initiative focusing on technology companies and the creation of a Corporate Services business.

In addition, he has led the successful development of Euronext’s Optiq® trading platform from 2017 to 2019.

From 2009 to 2013, based in New York, he served as Senior Vice-President and Chief of Staff at NYSE Euronext. Areas of responsibilities included strategy, technology and integration. In 2004, he was appointed as Executive Director, Head of Operations for Euronext. At the creation of Euronext in 2000, he was the Program Director for the integration of the French, Belgian and Dutch exchanges. Mr Attia began his career in the Paris stock Exchange in 1997.

Mr Attia is a member of the Board of Euronext Dublin and serves as Chairman of the Board of Directors of Elite Spa and Liquidshare SA. He is also the Vice-President of FESE, the Federation of European Securities Exchanges. He also served on the Boards of Euroclear Holding and LCH SA.

In 2020, he was recognised by Business Insider as one of 100 people transforming business, driving change and innovation in their companies and across industries.

He holds an Engineering degree in computer science, applied mathematics and finance.

The panel discussion will focus on the evolution of the CSDs ecosystem, the needs of the CSDs stakeholders and how CSDs can align with those.

Colin is the CEO of ISSA. He is responsible for creating & executing the ISSA strategy, growing the membership, and ensuring that ISSA continues to help shape the future of the Securities Services industry, through developing solutions and reducing risk. He also runs his own consulting business.

Prior to joining ISSA in September 2019, Colin co-founded a fintech (Atomic Wire) and set -up his own consulting business after almost 25 years at UBS.

At UBS he held a number of senior roles in the US, UK and Switzerland in both Operations and Finance, including running the global investment banking Operations and creating Finance Shared Services.

Colin holds a Bachelor’s degree in Money, Banking and Finance from Birmingham University (UK) and graduated from the Royal Military Academy Sandhurst.

Abdulla Abdin has Masters in Business Administration from the University of Glamorgan UK, and currently holds the position of Chief Operating Officer– Bahrain Clear. He is the Chairman of the Guarantee Fund Committee and Chairman of the African Middle East Depositories Association (AMEDA). Mr. Abdin has over 31 years of experience in Banking and Capital Market structure, regulations and operations.

Nandini Sukumar is the Chief Executive Officer of the World Federation of Exchanges, the global association for exchanges and CCPs. The WFE represents more than 250 exchanges and clearing houses globally, educating stakeholders on the vital role played by market infrastructures in the real economy and as a standard setter, finding the consensus on issues among the global membership. Of its members, 35% are in Asia-Pacific, 45% in EMEA and 20% in the Americas. WFE exchanges are home to 47,919 listed companies, and the market capitalisation of these entities is over $109 trillion; around $137 trillion (EOB) in trading annually passes through WFE members (at end 2020). WFE’s 57 member CCPs collectively ensure that risk takers post some $800bn (equivalent) of resources to back their positions, in the form of initial margin and default fund requirements. Ms. Sukumar is Vice Chair of IOSCO’s Affiliate Members Consultative Committee and Chair of the AMCC’s Sustainability Taskforce.

Florence leads the Brussels team with strategic and operational know-how from her work at the Federation of European Risk Management Associations (FERMA), where she was responsible for the management of relations with the European Commission and other European organisations, as well as communication and the organisation of events. Previously, she worked in the Brussels office of Mapfre Re on liability portfolio management and treaty analysis. She holds a degree in law, an executive MBA and a post-graduate degree in law and economics as well as a certificate in risk management. She speaks fluent French, Spanish and English and good Dutch .

Debbie is a Director in Securities Services managing sales and franchise clients investing in the U.S. She is the Chair of the Association of Global Custodian where she leads market collaboration and advocacy to facilitate more resilient and efficient global post trade execution markets.

In her prior immediate role, she was the U.S. Securities Country Manager where she managed over 6 trillion in assets under custody for clients domiciled in over 30 markets. She set the strategy, managed the U.S. Custody business and created a competitive product enabling client growth and increased market share. Debbie held multiple leadership roles in Industry Associations where she had a stellar track record to proactively initiate and lead market initiatives which fundamentally changed the market infrastructure and mitigate market risk.

Debbie joined Citi in 1997 as Citi Transaction Services Global Risk Manager in New York and was subsequently promoted to Operations Project Manager in Dublin to oversee Euro Implementation for Cash Management, Client Executive in American Depository Receipts servicing clients in the Middle East, Global Custody Marketing Manager and U.S. Custody Product Development Manager.

Prior to joining Citi, she was the Assistant Treasurer at IBM. She pursued a dual major in finance and accounting at the City University of New York where she graduated with honors and an M.B.A. in executive management from St. John’s University. Debbie holds several Board Membership positions including Women’s Diversity Network and New York State Midwifery Association. She is a proud “military wife,” mom of three, and is very passionate about volunteering.

This panel will speak about new CSD services (managing crowdfunding platforms, pension savings, consulting services, RegTech, SupTech, servicing new asset classes etc.), standardisation of market practices, cross-border optimisation

Jesus Benito is Head Domestic Custody & TR Operations, SIX.

He has been involved in the European CSD Association (ECSDA) as member of its Board of Directors and Executive Committee.

Jesús Benito has participated in numerous international Groups, among others: the European Commission’s Clearing and Settlement Advisory and Monitoring Expert Group (CESAME and CESAMEII), Monitoring Operating Group (MOG).

Before joining Iberclear in 2000, he worked for Banco de España from 1988 to 2000, as Head of Section responsible for CSD links and securities settlement policy issues.

He has a Business Degree from Complutense University.

An Attorney with more than 30 years of experience in the legal and commercial field of the financial sector and securities market. 28 years in senior and executive management with DCV, the Chilean Central Securities Depository.

Law Degree from Central University (Chile), MBA from the University of Deusto (Spain) Advanced Management Program (IESE), and the Mastering Innovation Program at The Wharton School – University of Pennsylvania (USA)

Currently, Javier is the Head of Legal and Corporate Affairs at DCV. He also currently serves as the President of the Americas’ Central Securities Depository Association (ACSDA).

He has a had lengthy career in advising on legal and regulatory matters at the corporate and board level, and with different regulatory entities of the financial sector and securities market in Chile and abroad.

Pierre Davoust is Head of Central Securities Depositories for Euronext since 2020 and Chairman of the Board of Euronext CSDs (Porto, Oslo, Milan and Copenhagen). He joined Euronext in 2019 as Head of Business Development.

Before joining Euronext, Pierre was Head of Markets at SETL, a UK-based distributed ledger company focusing on financial services, Chief Executive Officer of Iznes, a DLT-based mutual fund distribution platform and Non-Executive Director of ID2S, a DLT-based Central Securities Depository.

Prior to that, Pierre held various positions at the French Treasury, and served in particular as deputy head of financial markets.

Pierre holds Master’s degrees from Ecole Polytechnique, Ecole des Ponts ParisTech and Paris School of Economics.

Hanna Vainio is the Chief Executive Officer (CEO) for Euroclear Finland, the Finnish Central Securities Depository. Additionally, she serves in the Board of Directors of Euroclear Finland and is a member of the Extended Management Committee (EMC) of the Euroclear Group. She is based in Helsinki.

Since joining Euroclear in 2006, she has been the sponsor for various strategic and regulatory development initiatives and projects as the Chief Business Officer for Euroclear Finland and Euroclear Sweden and as the Deputy CEO of Euroclear Finland.

Before joining Euroclear, Ms. Vainio worked for six years at the Nordea Bank Finland as the Head of Corporate Actions.

Ms. Vainio is a member of the ECSDA Board. She has also been a member in several national and international working groups within the European financial industry during her career.

Ms. Vainio holds a Master’s degree in Economics and Social Sciences from the University of Helsinki (Finland).

Ekrem ARIKAN earned his bachelor’s degree in Computer Engineering from Boğaziçi University and his MBA from Yeditepe University. Currently, he is working on his PhD thesis at Istanbul Commerce University. He speaks English, German, and beginner-level Arabic.

He started to work for Microsoft as a Support Engineer in 1998, a Program Specialist in 1999, and a Program Manager in Windows International Product Development Group from 2000.

Then he started to work at Ziraat Technology (Fintek Financial Technology Services A.Ş., which is the IT company of biggest governmental bank Ziraatbank of Türkiye) as IT Architecture Manager from year 2007, Project Management Office Manager from 2009, IT Security Manager from 2011. In year 2013, he appointed as the Corporate Development Director.

In 2014, he assigned as the Information Technologies and Corporate Development Group Manager accountable for IT departments, Customer Services and Call Center, HR and Support Services at Ziraat Hayat ve Emeklilik A.Ş. which is life and pension insurance company owned by Ziraatbank.

In 2015, he moved to newly founded Energy Exchange Company EPİAŞ (Enerji Piyasaları İşletme A.Ş.) as an Advisor to Chairman and then appointed as the Strategy Development Director.

In year 2016, he started to work in CIO position by being EVP at Takasbank, which is the Central Counterparty of Türkiye, within the Borsa Istanbul Group.

Since April 2019, he has been working in CEO position as the General Manager and Board Member at MKK, which is the Central Securities Depository and Trade Repository company of Türkiye.

Indars Ascuks is the CEO of Nasdaq CSD and the Deputy Chairman of ECSDA. Indars has over 20 years’ experience working for Financial Market Infrastructures and has been responsible for implementing Nasdaq’s strategic initiatives in the Baltic and Nordic countries.

Indars has been leading the merger of the three Baltic CSDs and Icelandic CSD into a single Nasdaq CSD and has led the integration process of market operators in Latvia, Estonia and Lithuania into the international groups of exchanges, including Nordic OMX and Nasdaq.

Indars has actively worked in NGOs, such as Baltic Institute of Corporate Governance, as well as led the Latvian Securities Market Association, as well as has been chairing multiple Boards. Indars attained degrees after graduating from both the Stockholm School of Economics in Riga and the University of Latvia.

The panel will cover the questions of shortening the settlement cycle and speaking about the optimal settlement cycle for the markets. It will explore the efficiency gains as a result of the shortening of the cycle, the ways to get there, as well as the technology and the tools FMIs should use to enable it. The speakers of the panel include CCP experts, representatives of OTC markets.

Alessandro has spent over 30 years in financial services industry in different roles and responsibilities in trading and post trading.

Alessandro started his career in Citibank where he spent 11 years in Milan and London in Securities Services as Sales and RM.

In 2000 joined Unicredit investment bank as product manager for EuroTLX, MTF trading platform offered to retail banks. He was appointed in 2002 responsible for the spin-off and transformation of the platform into a regulated market and General Manager since 2009

In 2010 joined LSEG as General Manager of Monte Titoli and in 2012 appointed Head of Business Development for the Italian post trade services offered by Monte Titoli and CC&G

In 2020 appointed eHad of Business Development for Euronext Securities Milan responsible for financial institutions

Dr. DAI Wenhua is the Chairman of ACG, elected in 2019. He had more than 20 years’ experience in the securities industry. Dr. DAI had been with China Securities Depository and Clearing Corporation since 2001, retiring from the post of Chairman of the Board in 2020. Before that, he was Deputy General Manager at Shenzhen Stock Exchange from 1994 to 2012.

Dr. DAI has a PhD and Master in Engineering.

Mr. Prashant Vagal is Executive Vice President and Heads the Business Development and Products and Investor Education department in NSDL. He has completed Bachelor of Engineering and MBA in finance and over 26 years of experience in Capital Markets. Mr. Vagal has been associated with NSDL for 25 years now and handled various activities viz., Business development, Participant and CC Interface, New Product developments, Settlements, Training, Investor Education, Marketing etc. Mr. Vagal has been a speaker at various forums seminars held Internationally. He has been a member of Committees at SEBI and RBI.

Michele Hillery is General Manager of Equity Clearing and DTC Settlement Service at The Depository Trust & Clearing Corporation (DTCC). In this role, Michele has direct responsibility for the day-to-day management of equity clearing for trades executed on the major U.S. exchanges and other equity trading venues. She also oversees our ongoing efforts to collaborate with and build industry support for modernizing and transforming DTCC’s core businesses.

Michele has over 20 years in the industry and has held various positions within Product Management, Quality Assurance and Operations. Prior to joining DTCC’s Equity Clearing Product Management in 2013, Michele led the Fixed Income Clearing Corporation’s Mortgage Backed Securities Division (MBSD) where she managed the operations of the business and had responsibility over project development.

She earned a BBS from University of Limerick, Ireland and a MS from New York University.

Andy Hill is a Senior Director in ICMA’s Market Practice and Regulatory Policy team, where he oversees globally the association’s work on fixed income secondary markets, as well as repo and collateral markets.

Andy has authored numerous reports on bond and repo market structure and development, with a particular focus on regulatory impacts.

Prior to joining ICMA in 2014, Andy was a repo and money market trader for seventeen years, for ten years of which he was an Executive Director at Goldman Sachs.

He has also worked as a consultant in the Aid and Development sector, primarily based in Cambodia, and previously served on the Board of the Cambodian NGO Education Partnership in Phnom Penh while on a Goldman Sachs Public Service Fellowship.

Andy holds a BSc (Hons) in Business Studies from Cass Business School and an MSc in Poverty Reduction and Development Management from the University of Birmingham.

Alexis Thompson is Head of Global Securities Services for

BBVA. He is also responsible for Strategy & Business

Development for Global Transaction Banking within

Corporate & Investment Banking.

He joined BBVA in 2012 as Head of Product in Global

Operations where he was charged with aligning operational

capabilities with the needs of the different business lines.

Prior to that, Alexis worked at Altura Markets for 12 years

as Chief Operating Officer, where he was responsible for

Client Services, Operations and IT.

Mr. Thompson holds a BA (Hons) degree in Hispanic &

Latin American Studies from King’s College London.

The panel will explore the long-term view and major priorities of the top management of the leading post-trade infrastructures.

Dr Kay Swinburne is the Vice Chair of KPMG UK’s Financial Services practice, Chair of KPMG’s EMA Risk & Regulatory Insight Centre, and Co-lead of KPMG’s Global Sustainable Finance Service, leading C-suite engagement for FS clients and advising KPMG’s UK, EMA and global FS leadership. She’s an active voice in the market and leads special projects on ESG, EU/UK political issues and financial regulation – including Fintech, UK competitiveness and market infrastructure (MiFID).

Kay is the Chair of the International Regulatory Strategy Group (IRSG) leading one of the most influential regulatory and strategy cross-sectional groups in Europe which is co-sponsored by TheCityUK and the City of London Corporation. She is also a board member of TheCityUK.

Prior to joining KPMG, Kay was a Member of European Parliament (2009-2019), serving as Vice Chair of the Economics and Monetary Affairs Committee. This role saw her shape EU and global financial services legislation, including setting up the EU supervisory bodies (ESAs, SSM, SRM), capital markets union (EMIR, MiFID II, Prospectus, CCP Recovery & Resolution), and the broader banking union files.

Since January 2017, Lieve Mostrey has been Chief Executive Officer of Euroclear Group.

Ms. Mostrey joined Euroclear in October 2010 as Executive Director and Chief Technology and Services Officer of the Euroclear Group and an Executive Director of the Board.

Prior to Euroclear, Ms. Mostrey was a member of the Executive Committee of BNP Paribas Fortis in Brussels, where she was responsible for IT technology, operations, property and purchasing. Ms. Mostrey began her career in 1983 within the IT department of Generale Bank in Brussels, moving to Operations in 1997 and, upon its merger with Fortis in 2006, became country manager for Fortis Bank Belgium. She became Chief Operating Officer of Fortis Bank in 2008, which was acquired by BNP Paribas in 2009.

Ms. Mostrey was previously a Non-Executive Director of SWIFT, RealDolmen, Visa Europe and of Euroclear. She was until recently a member of the Supervisory Board of Euronext.

Lieve Mostrey is a member of several initiatives contributing to develop the financial sector:

Having earned a degree in civil engineering from Katholieke Universiteit Leuven in 1983, Ms. Mostrey completed a post-graduate degree in economics from Vrije Universiteit Brussel in 1988.

As a hobby, Lieve Mostrey enjoys playing golf.

Stephan Leithner has been appointed as Member of the Executive Board of Deutsche Börse Group at the beginning of July 2018. He is responsible for the Group’s post-trading business (Clearstream), and pre-trading (ISS, Qontigo) businesses.

Stephan Leithner served as a Partner of the leading alternative investments firm EQT since 2016. Previously, he acted as a Member of the Management Board of Deutsche Bank AG from 2012 until 2015, where he had held a number of leadership positions in Global Banking since 2000. Further work stations include McKinsey & Company as well as the Swiss Institute for Banking and Finance in St. Gallen, Switzerland.

He has a PhD in Finance and a Master in Business Administration from University of St. Gallen.